- Home

- Telematics

- Vehicle tracking

- Insurance approved vehicle trackers

Insurance approved vehicle trackers

Insurance approved vehicle trackers can support your business operations by lowering your fleet costs and protecting your drivers.

What is an insurance approved tracker?

An insurance approved vehicle tracker monitors the real-time location and movements of a vehicle. As for the ‘insurance approved’ part, these trackers meet specific standards set by insurance companies. Their enhanced security features and accurate tracking data are recognised by insurers, which leads to lower insurance premiums.

Insurance approved trackers are essential for vehicle protection. They ensure vehicles can be quickly located and recovered in the event of theft, ultimately saving your business from significant financial losses.

Why you need an insurance approved tracker

You want to protect your valuable assets and reduce operational costs. These two reasons alone are why an insurance approved vehicle tracker is a must for your business. Our GPS-based devices supply real-time location tracking, which provides peace of mind and enhanced security against theft. By also meeting specific insurance standards, these trackers can offer substantial savings in the form of lower insurance premiums.

Furthermore, the ability to monitor and manage your vehicles remotely improves asset utilisation, operational efficiency, and overall fleet management.

Key benefits of insurance approved trackers from Radius

Enhanced security: An insurance approved vehicle tracker delivers real-time location data and theft alerts. This ensures vehicles are protected and can be quickly recovered if stolen.

Lower insurance premiums: As our trackers are recognised by insurers, they help reduce your insurance costs. The result is significant savings over time.

Improved asset management: Track and monitor vehicle usage to optimise operational efficiency, which supports the improvement of overall fleet management.

Geofence alerts: Set virtual boundaries for your vehicles with our geofence alerts technology. You receive instant notifications if your vehicles move beyond their predefined areas.

Easy installation: Our trackers are small, battery-powered, and can be easily self-installed – no professional assistance necessary.

Extended battery life: Our long-lasting battery performance delivers reliable performance and continuous fleet tracking, all without the need for frequent replacements.

Vehicles that can use an insurance approved tracker

Optimise the performance of your fleet with our advanced van tracking solutions, designed for efficiency and security.

Maximise logistics efficiency with our truck tracking solutions, tailored for the unique demands of heavy goods vehicle fleets.

Experience unparalleled peace of mind with real-time car tracking, ensuring safety and control over your company vehicles.

Embrace the future with our EV tracking, offering electric fleet visibility and insights to drive fleet performance and optimisation.

How our tracking devices work

We offer a diverse selection of GPS tracking devices to create the ideal solution for your business. Our GPS vehicle tracking devices provide everything you need for essential vehicle tracking, ensuring you have the tools to manage your fleet effectively. Whatever your requirements, we have a vehicle tracker that delivers the telematics data and insights you need for efficient fleet management, helping you monitor and optimise your operations.

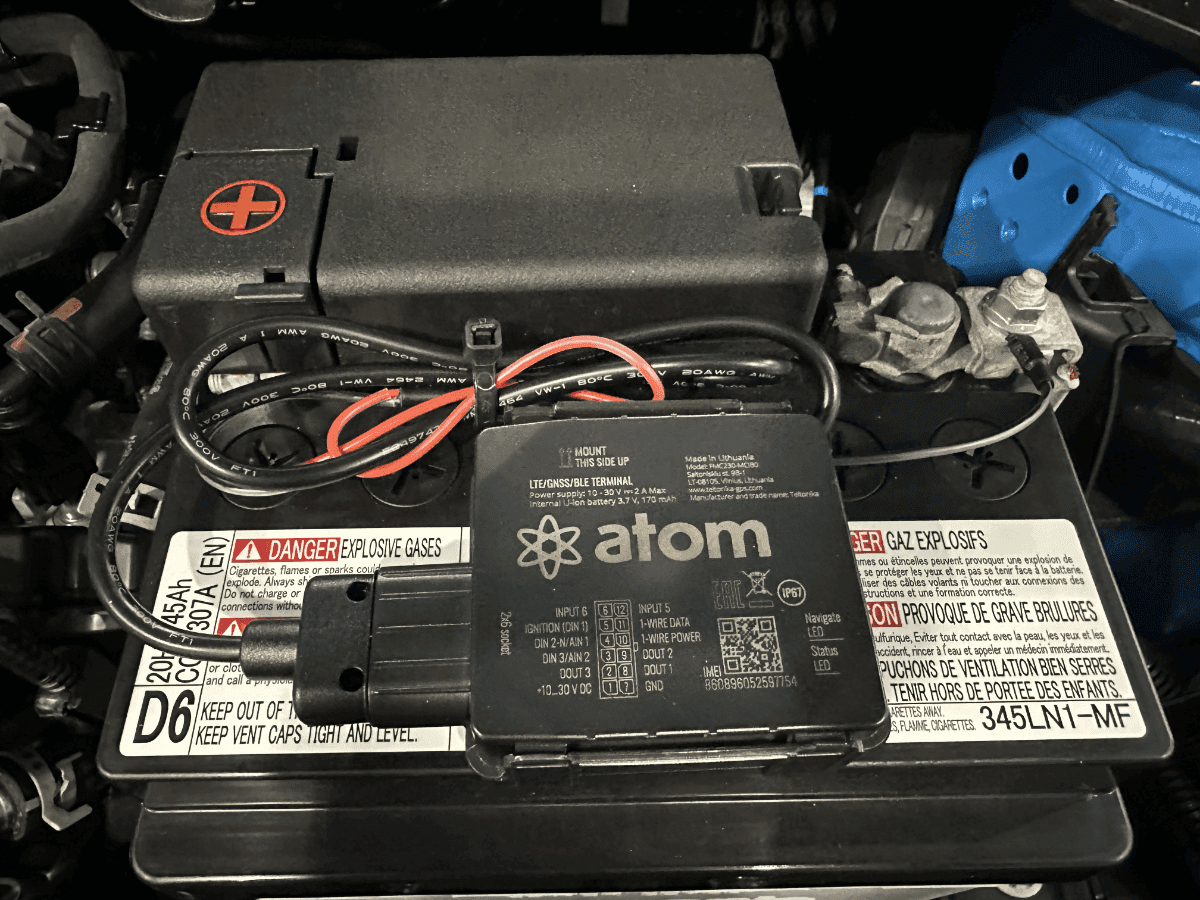

Installing insurance approved trackers

At Radius, we offer various GPS tracking devices to cater to your specific needs. You have the option to either install the GPS insurance approved tracking device yourself or have it professionally installed by one of our engineers.

Our self-install tracking devices are powered either by the vehicle battery or connect through the vehicle's ODB port, capturing additional data from each vehicle

Whatever your needs, we will ensure you have the ideal GPS device for your business.

Our stolen vehicle recovery service

Our asset and vehicle trackers are essential for asset recovery, boasting an impressive 95% recovery success rate. These advanced devices provide real-time location data, allowing you to monitor and locate valuable assets swiftly and accurately in case of theft. By continuously tracking your assets, our technology ensures they remain secure and recoverable.

In Australia, having a reliable tracking system can also positively influence your insurance coverage. Insurers often view advanced tracking solutions as a proactive measure to mitigate theft risks, potentially leading to better coverage options and lower premiums. Trust our tracking technology to safeguard your assets and enhance your insurance benefits.

Frequently asked questions

Can’t find an answer to your question? Talk to the Radius customer support team on 1800 723 487. We’re here to help you with any questions or concerns you may have.

How does insurance-approved vehicle tracking work?

Why do insurance companies recommend vehicle tracking systems?

Are insurance-approved vehicle tracking systems compatible with all types of vehicles?

Do insurance approved trackers from Radius require a subscription?

Why choose Radius?

With innovative solutions built around the needs of our customers, we've established an international reputation for helping businesses grow sustainably.

Expertise

Our team has over 34 years of experience helping more than 400,000 customers globally.

Trust

We are an internationally-acclaimed provider with numerous awards for our products and services.

Choice

Choose from our range of fleet, mobility and connectivity solutions that can be tailored to suit your needs.

Solutions

Use our award-winning technology and services to save your business time and money.

Can’t find what you are looking for?

The customer support team at Radius has a global reach with over 50 offices to offer local contact with an international presence. Let us know how we can help.

Contact us